Calculation of depreciation on rental property

For example there is the Accelerated Cost Recovery System ACRS and the Modified Accelerated Cost Recovery System MARCS. As such you can deduct only.

Residential Rental Property Depreciation Calculation Depreciation Guru

Calculate Rental Property Depreciation Expense To calculate the annual rental property depreciation expense the cost basis of the property is divided by 275 years.

. Calculate depreciation used for any full year and create a depreciation schedule that uses mid month convention and straight-line. Lets say the investor is in the 25 tax bracket for simple math. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals.

Depreciation in real estate is basically a tax benefit that allows investors to save money on their income properties. In this case since residential rental property can be depreciated for 275 years you would depreciate 4589 per year. For example if a new dishwasher was purchased for 600 had an estimated useful life of five years and would be worth 100 at resale at the end of the five years then the annual depreciation using the straight-line method.

Amount of depreciation expenses that you can claim per year. Annual Depreciation 50000 275 181818 COMMENTS. How to Calculate Rental Property Depreciation.

But to keep things simple for now were. In our example lets use our existing cost basis of 206000 and divide by the GDS life span of 275 years. It works out to be able to deduct 11200 per year or 36 of the loan amount.

Total improvement cost is 15000. Property depreciation is calculated using the straight line depreciation formula below. This is known as the straight-line method for calculating depreciation cost and its the only acceptable formula for calculating the depreciation cost of a property according to the IRS.

How depreciation can lower your taxes. Calculating rental property depreciation is simple and quite easy if you use the straight-line formula. Purchase price land value improvements 200000 40000 2000 180000.

Once they purchase a rental location they likely just have to do updates and. 369000 property cost basis 275 years 1341818 annual depreciation expense. The Bottom Line Depreciation is a valuable tool for rental property owners as it allows you to spread the cost of buying over time and reduce your yearly tax bill.

First there will be a long term capital gain above and beyond what the property was initially purchased for but there will also be an ordinary income tax based on the investors marginal tax bracket assessed against the 100000 of recaptured depreciation. If the home was not available for rent for the full year divide the number of service months by 12 and multiply the result by 126000. If you wanted to calculate the amount that can be depreciated each year youd take the basis and divide it by the 275 year recovery period.

Half of this we are using for personal use and half for rentTotal cost of land which is used is 200000. To calculate your initial cost basis you would take. Lets consider the above example for this cost basis of 308000 and divide by the GDS life span of 275 years.

When you buy a rental property you can deduct most of the expenses you incur keeping it up thus lowering your taxable income. You also plan on spending an additional 30000 to renovate it before selling. Amount paid when you bought.

Lets say you paid 200000 for a rental property but its sitting on a 40000 plot of land. Now will calculate its annual depreciation with following way. To calculate the depreciation cost of a property divide the basis cost by the recovery period which is 275 years for residential income properties.

Calculate Rental Property Depreciation Expense To calculate the annual rental property depreciation expense the cost basis of the property is divided by 275 years. Annual Depreciation Purchase Price - Land Value Useful Life Span in years Annual Depreciation. 99000 275 3600 per year.

To calculate the annual amount of depreciation on a property you divide the cost basis by the propertys useful life. It works out to being able to deduct 749091 per year or 36 of the loan amount. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

In the eyes of the IRS most of these expenseslike maintenance repairs property taxes and mortgage insuranceget used up immediately. A rental property depreciation calculator can be a great tool for investors looking to find out the depreciation on their rental property. Now you need to divide the cost basis by the propertys useful life to calculate the annual depreciation on a property.

However the IRS has a few different ways of calculating depreciation. To do it you deduct the estimated salvage value from the original cost and divide by the useful life of the asset.

Residential Rental Property Depreciation Calculation Depreciation Guru

Renting My House While Living Abroad Us And Expat Taxes

Rental Property Depreciation Rules Schedule Recapture

How To Calculate Depreciation On A Rental Property

Depreciation For Rental Property How To Calculate

How To Depreciate A Rental Property Formula Excel Example Zilculator Real Estate Analysis Marketing

Rental Property Depreciation Rules Schedule Recapture

How To Calculate Depreciation On Rental Property

Straight Line Depreciation Calculator And Definition Retipster

Depreciation For Rental Property How To Calculate

How To Use Rental Property Depreciation To Your Advantage

Real Estate Depreciation Meaning Examples Calculations

How To Report The Sale Of A U S Rental Property Madan Ca

How To Depreciate A Rental Property Formula Excel Example Zilculator Real Estate Analysis Marketing

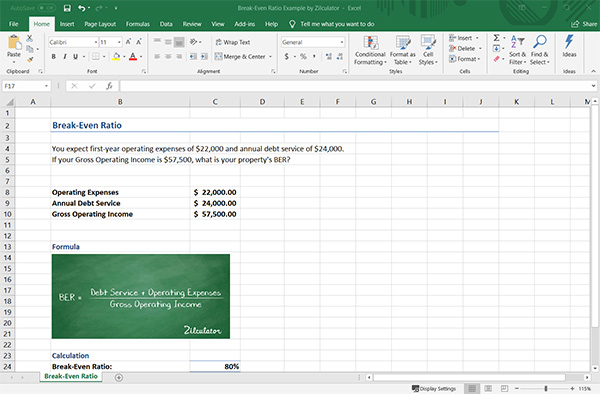

3 Ratios To Start Tracking Now Rental Property Calculator Accidental Rental

Part 2 How To Prepare A 1040 Nr Tax Return For U S Rental Properties

Straight Line Depreciation Calculator And Definition Retipster